The

financial crisis of 2008 was a major turning point in our country’s

history. The stock market had multiple days of losing hundreds of points

as the political and economic institutions and the leaders grappled

with ways to staunch the bleeding (Amadeo). The inflection point of the

crisis coincided with a presidential election. That election was polling

close until Barak Obama pulled away and won, placing the Democrats at

the head of the executive branch while they still had their majority in

both houses of congress that they gained in 2006. During the transition,

Congress passed a bailout for the banks known as TARP (Troubled Asset

Relief Program), and the Federal Reserve flooded banking the system with

liquidity, pushing the federal funds rate to its lowest point in

history (Amadeo). As Obama came into office, he and his economic

advisors realized that the lame-duck motions of the end of the Bush

Administration would not be enough to fill the hole left by the

financial crisis. Obama and the new congress narrowly passed a stimulus

of $787 billion dollars. The bill, ARRA (American Recovery and

Reinvestment Act of 2009), was designed such that even though many

people saw direct benefits from the new law, it did not create a new

constituency. In fact, some polls showed that people thought that their

taxes increased (“ARRA”).

The

effects of ARRA were welcomed, but even looking back in 2015, the CBO

estimated the program had limited effect: “The effects of ARRA on output

peaked in the first half of 2010 and have since diminished CBO

estimates. The effects of ARRA on employment are estimated to have

lagged slightly behind the effects on output; CBO estimates that the

employment effects began to wane at the end of 2010.” (“Impact”, p 3).

The limited effects were anticipated at the start from some economists.

Paul Krugman, Nobel Prize winner and New York Times Columnist, gave a

speech in early 2009 noting: “[ARRA]’s helpful, but it does not cover

even one-third of the gap, so it’s disappointing. Out of the $789

billion approved, only about $600 billion adds real stimulus. You’ve

only got $600 billion to fill a $2.9 trillion hole.” (America).

Economists like Krugman wanted the stimulus package to be big enough to

fill the hole that was created with the crisis and to kick-start

spending. Even with a headline number that made all but the most jaded

gasp, the number was not big enough to fill the hole and create the jobs

needed to get the economic activity up to par, with what it had been

before the recession had started.

The

recession, however, was a bit different from other recessions. Between

the depth of job losses and the slowness of the recovery, the Brookings

Institute estimates that though the absolute number of jobs hit the

pre-recession level as of April 2014, it was not until July of 2017 that

the overall gap closed adjusting for demographic variables such as

population growth and aging. This now decade-long recovery had economist

calling the recovery “L-shaped” or a “jobless recovery” since similar

returns to normalcy aftershocks in 1981 and 1990 only took 40 and 48

months (“jobs gap”). The same study notes that the recession and

recovery were also notable for variabilities in place and race and

educational attainment. In addition, where the real-estate bubbles were

higher, the crash was greater, and the recovery took longer. For whites,

and those with more education, the crash was not as deep nor as long

lasting in term of overall employment.

The

depth of the crash and the long duration of the recovery matters in

part because the political response. Once Obama was sworn in as

President, Republicans in congress dragged their feet on teaming with

the Democrats. Despite attempting to work with the Republicans, the ARRA

stimulus was passed with no GOP votes in the house and only three

voting in the Senate. (Calmes). The dissatisfaction with the recovery

effort spread out from the halls of congress. In early 2009, Rick

Santelli, a commentator on the cable financial news channel CNBC, went

on a tirade broadcasting from the floor of the Chicago Mercantile

exchange, saying, “The government is promoting bad behavior. How about

this, president and new administration, why don’t you put up a website

to have people vote on the Internet as a referendum to see if we really

want to subsidize the losers’ mortgages.” Then he turned, and the

traders clapped, adding, “President Obama, are you listening? We’re

thinking of having a Chicago Tea Party in July. All you capitalists show

up to Lake Michigan, I’m going to start organizing. I’ll tell you what:

If you read our Founding Fathers — people like Benjamin Franklin and

Jefferson — what we’re doing in this country now is making them roll

over in their graves.” (Kirell). Santelli’s monologue started a movement

that had been coalescing against President Obama and the Democrats. The

GOP in the next years at the federal level dug in its heels and opposed

any initiatives in the House and the Senate that the Democrats

proposed, from health care reform to lowering the risks in the banking

system to try to stave off another crisis of the magnitude of that in

2008. (Staff). The Tea party resistance to Obama paid off for the

Republicans as in 2010 where the Republicans lowered the Democrats’

majority to below the filibuster-proof threshold and gained an absolute

majority in the house (“Senate Results Map”). Republicans were heartened

with their new powers, with Speaker Boehner outlining his plan: “The

single most important thing we want to achieve is for President Obama to

be a one-term president.” (Barr).

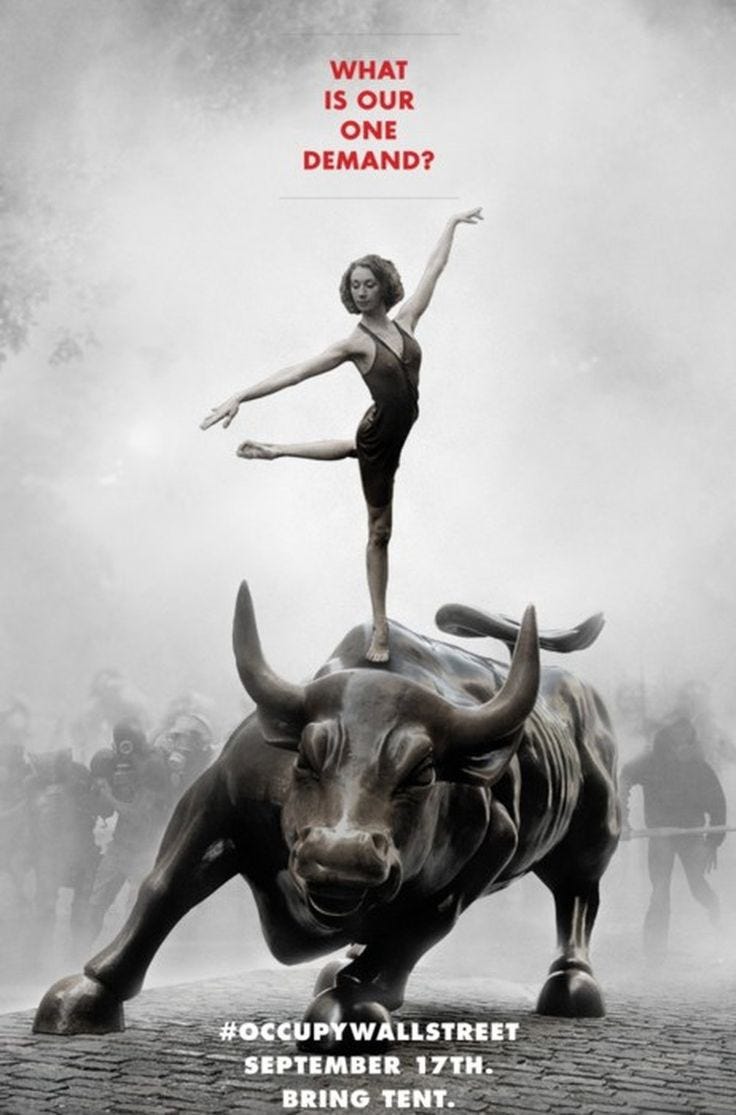

The

backlash to the bailouts and the slow recovery was not just on the

right. After the wave election that put many of the Tea Party

Republicans in place, there was a movement on the left. Posters from the

magazine Adbusters went up in New York and spread on social media. The

poster had a ballerina standing atop the famous Wall Street Bull statue.

On the bottom was the “hashtag #OccupyWallStreet. From an initial

protest, the Occupation grew. It was not just at the original planned

site in lower Manhattan. Encampments grew up in cities large and small

in the fall of 2011. The main criticism of the encampment was that there

were no direct demands. Occupy was a loose confederacy of anarchical

gatherings. Winter came and the police broke up the main encampment. The

ultimate legacy of the gatherings was that a new light was brought on

the gross inequities of wealth and income that existed in our society.

Wall Street bankers had to look face to face with protesters in the

camps. Online, the phrase “We are the 99%” spread as people told their

stories and spread them with their social media networks. (Lalinde).

There was not as strong an electoral consequence with the Occupy

Movement as there was with the Tea Party. Obama did win reelection

against Mitt Romney in 2012 but did not make up for the wave election in

the house or greatly make any movement in the Senate. (“Election

Results”) Bernie Sanders, Senator from Vermont, used rhetoric that was

familiar to the Occupiers in his bid for the Democratic Nomination in

2016. This bid was ultimately unsuccessful as he lost to entrenched

party favorite Hillary Clinton. Clinton, in turn, lost to the GOP

candidate Donald Trump who won a narrow victory speaking with

exclusionary language and nationalistic triumphalism, running an outside

campaign like the Tea Parties eight years earlier.

The

crisis of 2008 was such a turning point for the United States because a

clear line can be drawn from the crash and the response to it both from

monetary and fiscal policy standpoints and the rhetoric surrounding

that response from both sides of the political aisle. The response

echoes down today to our president threatening trade wars with anyone

who looks at him funny with the lowering of the tax rates on high

earners and their capital gains. What it comes down to on both sides are

questions of distribution and equity. How do we define the pie, how do

we decide how it is divided, and who gets what parts of the pie? In this

paper, we will explore the ideological response to the crisis, as

inequality gained greater attention after 2008. We will examine

gathering evidence of inequities with the American economic system as

these inequities exacerbate and give lie to the idea of America as the

land of equality and the land of opportunity. Finally, we will suggest a

different ethical framework for evaluating the economic systems, and

show how policy choices can be driven by that framework.

There

are several different ways to look at what the pie means economically.

The first way is to define income that comes in on an hourly basis or in

terms of salary. Other things that we might include in this measure are

such things as benefits or bonuses or deferred income. This measure of

wage income is defined as pay. To take a broader conception of the money

coming in, there are many other ways that someone could receive a flow

of funds such as dividends, capital gains, royalties, and rent. The sum

of all the money coming in over a defined time span is your income.

(Galbraith p. 2)

A

different way to look at the pie is to see the total of a collection of

assets. As James Galbraith explains, this sum “includes financial

assets, such as money, and stocks and bonds at their market value. It

includes the value of houses, real estate, art, automobiles, jewelry,

and other possessions, net of any debts held against them. And it

includes the capital value of present or future income flows.”

(Galbraith p. 3).

Once

the pie is defined, there are several different ways to compare the

differences in either income or wealth. One can look at an individual’s

share of the pie, or perhaps the household’s share of the pie. The

aggregate totals at a high level can be looked at to get a sense of the

distribution and to examine how the overall distribution has changed

over time. As Galbraith notes, one simple way to make comparisons is to

“line all the observations from low to high and to count them off in

percentage terms, point by point” (Galbraith p. 61). This ordinal

comparison then allows the examiner to look at ratios of certain

percentile groups, for example, how much income the group in the middle

as earns defined by the 50th percentile as how the group at the 90th

percentile earns much income.

One

of the most common measurements of inequality is the Gini Coefficient.

The Gini Coefficient is based on the Lorentz curve. To map out the

coefficient, one takes the cumulative share of income and draws out a

curve against the cumulative share of people. If there were perfect

equality in the population being studied, the curve would be a straight

line with a 45-degree angle. In practice, there are very few examples of

perfect equality. What is seen instead is that as you move from left to

right, the total share of the income grows slower than the total share

of people. In all but perfectly populations, the units on the right will

have more than the units on the left. This creates a curve that is

below the line of equality, and the Gini Coefficient is measured as the

ratio of the area between the line of equality and the Lorentz curve

over the total area. The more unequal in distribution the wealth or

income of population is, the higher the Gini Coefficient. The highest a

Gini Coefficient can theoretically be is a measure of one, where one

person accrues all the income or wealth of a measured population

(Galbraith p. 64–65). At the other end would be where all members of a

population have equal share of the resources.

Having

a measurement like percentile ratios or the Gini Coefficient means that

you can start to measure inequality within or across countries and

across time. In the western countries, especially the United States, the

broad consensus is that in the past few decades inequality is

increasing. Galbraith notes “The economies of almost all nation states

have experienced significant increases in economic inequality in the

past generation, so that with almost no exceptions, the world’s people

belong to more unequal countries than they did in 1960 or even in 1980”

(Galbraith p 123). Branko Milanovic, former chief economist of the IMF,

traces the move in US Gini from “a historically low level of about 35

Gini points until the trough in 1979. After that, it rose steadily,

reaching over 40 Gini points by the second decade of the twenty-first

century (Milanović p. 71). French Economist Thomas Piketty looks at

similar data and calls the increase in income inequality an “explosion,”

as the US income for the upper decile (top ten percent) increased from

between 30 to 35 percent to between 45–50 percent. Piketty postulates

that “The shape of the curve is rather impressively steep, and it is

natural to wonder how long such a rapid increase can continue: if change

continues at the same pace, for example, the upper decile will be

raking in 60 percent of national income by 2030” (Piketty p. 294).

Ultimately,

this high and increasing inequality of both wealth and income in the

United States is detrimental because there are many negative social

effects. We have already seen one of these, in the political

polarization that has become exacerbated since the financial crisis in

2008. The crisis was like the tide going out. The false good times of

the bubble that preceded the crisis masked many negative effects of

inequality that existed — and not just the loss of jobs, income, and

wealth that the crisis carried with it. In The Price of Inequality, Nobel-Prize

winning economist examines in-depth many ways that the high

inequalities were exacerbated by the crisis. One of these is that the

composition of wealth for earners at different point on the distribution

scale. Stiglitz notes that the poor and middle class, if they have any

positive net worth at all, have most of their wealth tied up in their

housing stock. So that when the housing market turned downward, it is

these people with their wealth tied up in housing that suffered most. He

notes that on the well-off side of the scale this was less of an issue:

“At the top, CEOs were remarkably successful in maintaining their high

pay; after a slight dip in 2008, the ratio of CEO annual compensation to

that of the typical worker by 2010 was back to what it had been before

the crisis, to 243 to 1” (Stiglitz p. 3).

This

greater bifurcation between the middle and the top creates unequal

societies, and not just in theory. Stiglitz dreads a world full of gated

communities for the rich while the poor and middle class exist as

servants, a world where “populists promise the masses a better life,

only to disappoint”. He continues drawing this word as one where there

is an absence of hope for most people, knowing that their state in life

is one that they cannot move on from (Stiglitz p. 3). These are lines

written in 2012 but speak to us now as uncanny warnings from the past.

Stiglitz draws a grim picture of the American economy as he saw it when

he was writing in the immediate aftermath of the Tea Party wave and the

rise of the Occupy Movement. For him, those at the top were capturing

most of the gains and inequality was increasing. In addition, there were

many different policy decisions that led to a more precarious existence

at the lower end of the distribution. The economy as a whole was

growing slower, so what growth the poorer were able to capture was less

and less. The safety net was in tatters as unemployment insurance, food

stamps, and cash assistance were increasingly hard to get. For those who

had lost their jobs in the recession, the federal government stopped

extending unemployment even though the job market remained weak. These

problems led to problems with health, with Stiglitz highlighting that

“America’s poor have a life expectancy that is almost ten percent lower

than that of those at the top” (Stiglitz p. 14). Even those that have

fought through these limitations, there is less equality of opportunity.

A poor child who does well in school is less likely to graduate than a

rich child who does not do as well in school; even after graduating, the

children of the poor are less well off than the children of the rich

(Stiglitz p. 19). For Stiglitz, this can be summed up that “America has

more inequality than any other advanced industrial country, and it does

less to correct these inequities, and inequality is growing more than in

many other countries” (Stiglitz p. 24).

The

problems with inequality are not just at the individual or economic

level. For Stiglitz there is an invisible thumb on the scale, as

inequality is not just driven by market forces. Instead, “much of the

inequality that exists today is a result of government policy, both what

the government does and what it does not do. Government hast the power

to move money from the top to the bottom and the middle, or vice versa”

(Stiglitz p. 30). This illustrates the main social problem with

inequality as Stiglitz sees it. Inequality does not just happen, or if

it does the impact is not made better through policy, instead it is

often increased through various kinds of rent-seeking such that: “Those

with power use that power to strengthen their economic and political

positions” Stiglitz p. 29). Those with power have done such things as

using their political influence on shape policy that is pro-business

instead of pro market (Stiglitz p. 35), they have created a vast

financial system that absorbs more value than it creates, funneling

resources to the top (Stiglitz p. 37). They have maneuvered themselves

to be granted license to valuable natural resource deposits (Stiglitz p.

39) or created barriers of entry to business, creating monopoly rents

that those at the top can take advantage of (Stiglitz p. 44). All these

structures allow the already powerful and wealthy to cement their hold

on the income and wealth of the country. It also creates a positive

feedback loop that is positive only for them, as it allows them to

capture more resources which in turn gives the already rich more money

and then more power and so on to the third and fourth degree.

Not

everyone believes in a critique of inequality like that presented by

Stiglitz. In 2013, Harvard Professor Gregory Mankiw made waves with his

essay “Defending the One Percent” that was eventually published in the Journal of Economic Perspectives.

In the essay, Mankiw directly dismisses Stiglitz’s thesis, saying, “I

was not convinced. Stiglitz’s narrative relies more on exhortation and

anecdote than on any systemic evidence. There is not good reason to

believe that rent-seeking by the rich is more pervasive today than it

was in the 1970s” (Mankiw p. 26). Instead, Mankiw makes the case for

what is called “skills-based technological change” where the demand for

skilled labor goes up and thus the pay rate for those possessing the

valued skills goes up in tandem with the demand for their skills. In the

essay, Mankiw tries to diminish the arguments of people who think that

inequality is a problem. For example, he looks at the finance industry

and sees not a nest of rent seeking, but instead an issue “primarily one

of efficiency. A well-functioning economy needs the correct allocation

of talent. The last thing we need is for the next Steve Jobs to forgo

Silicon Valley in order to join the high frequency traders on Wall

Street” (Mankiw p. 24). For Mankiw, the one percenters will become one

percenters no matter where in the economy they are, so what we need to

worry about socially is not that they exist, but that they are doing

productive jobs in the economy. He is also not concerned that many of

these top earners come from families of top earners. Mankiw looks at a

measure of mobility that Stiglitz draws, one where we should measure the

odds of ending up in the top ten percent and say that a well-structured

society, these odds would be the same for the rich child or the poor

child. Mankiw waves that away by saying we should be looking more at the

state of the poor and not the lofty heights of the rich (Mankiw p 25).

Mankiw

is not the only supporter of the current level of inequality. In a

title similarly wearing its allegiances on its sleeve, Edward Conard, a

former business partner of Mitt Romney, released a book in response to

the rising interest around inequality, called The Upside of Inequality. In

it, Conard tries to show why many of the points that more left-wing

economists make about inequality are more myth than truth. He argues

that incentives do matter, that those at the top have earned their pay,

that there is no secular stagnation and investment opportunities are out

there, that the middle class is doing well, and that mobility has not

declined. The thesis he goes back to repeatedly is that “Higher payoffs

for success increase the supply of properly trained talent, and these

higher payoffs motivate innovators, entrepreneurs, and investors to take

risks. […] Faster growth increases middle- and working-class wages when

the supply of lesser-skilled labor is constrained” (Conard p. 5). Now,

Conard is not an economist and he is writing to non-economists from his

class position, but he does occupy a space in the business and

publishing elite by previously having been a best-selling author. Thus,

his pronouncements do hold some weight when he claims that the “Critics

of the 1 percent are wrong” that they have not achieved their success

through cronyism or unearned rents, instead they “have largely earned

their success by commercializing successful innovation” (Conard p. 189).

As we saw earlier, he is not a lone voice, but echoing the arguments of

a noted Harvard professor writing in the AEA’s general interest

journal.

To

fully determine which of the two sides is right, we need to turn

towards the stories we tell ourselves about ourselves to examine the

criteria by with we judge which is more correct. Does the economic

system as it exists reward those who are already powerful through

various rents that are created and enforced by the well off, or is the

economy a blind lottery that is rewarding the skilled without hindering

the advancement of people through the class structure?

One

of the things that is fairly unique about the United States that it

shares with other nations of the Americas is that it is new as a

country. By the time of independence, there had been only a century and a

half of continuous European settlement. This framing is not to dismiss

the tens of thousands of years of native settlement of the land of the

Americas. They played a role in inspiring some of our political ideals

(Loewen p. 82), as well as playing a continual role in these stories as

the dwellers on the frontier as mutual contact changed both cultures

(Loewen p. 110). The land that we call the United States was not a

tabula rasa for the white settlers, but instead an active social plane

that was depopulated in acts of plague and famine through settler agency

and negligence. That is not the story that we tell about ourselves. The

native peoples are often side characters if they come up at all. The

story of America that we tell the children so that they are proud to be

Americans often starts with settlement in the early 1600s with some

people in buckled hats and then jumps forward to developed cities in the

1770s. It is there, in Philadelphia where the name that are familiar to

schoolchildren laid pen to paper, declaring their sovereignty as men:

“We hold these truths to be self-evident, that all men are created

equal, that they are endowed by their Creator with certain unalienable

rights, that among these are Life, Liberty and the Pursuit of happiness”

and declaring their sovereignty from the British yoke: “ these United

Colonies are, and of Right ought to be Free and Independent States”

(“Declaration”). This document kicked off a war in which the small

rebellious band of patriots showed that freedom from the yoke of tyranny

was possible, and to set forth on a road to self-governance was the

goal of the enlightened men. In popular imagination, the Articles of

Confederation might as well not exist, so the next step after declaring

independence and beating the English was to write the constitution.

These men got together and debated a new social contract in a way that

has not been fully replicated in our nation’s history. The Constitution

was the best possible, state of the art. It had three branches, and a

stronger legislature than the other two branches. It also had a Senate

that was answerable to the states and a House of Representatives that

was answerable to the people.

The

story of America is not a single strand of triumph, however. The story

of America has been one of conflict both physical and ideological. Often

you hear the initial conflict between the Hamiltonians and the

Jeffersonians, the original urban rural divide, and one that grew even

from the document itself, one that enshrined slave-holding while

declaring at the start “We the People of the United States, in Order to

form a more perfect Union, establish Justice, insure domestic

Tranquility, provide for the common defence, promote the general

Welfare, and secure the Blessings of Liberty to ourselves and our

Posterity” (“Constitution”). It was this document, measured but

imperfect that Hamilton, Jay, and Madison defended in the Federalist

Papers, asking, “Whether societies of men are really capable or not of

establishing good government from reflection and choice, or are forever

destined to depend for their political constitutions on accident and

force.” (Hamilton et al p. 27). The founders, for all their faults,

worked at a groping towards perfectibility — an ideal that is forged in

enlightenment thought. This perfectibility was bound up in conflict. In

another of the Federalists, Number 10, Madison recognizes the competing

claims on wealth and power in a republic:

But

the most common and durable source of factions has been the various and

unequal distribution of property. Those who hold and those who are

without property have ever formed distinct interests in society. Those

who are creditors, and those who are debtors, fall under a like

discrimination. A landed interest, a manufacturing interest, a

mercantile interest, a moneyed interest, with many lesser interests,

grow up of necessity in civilized nations, and divide them into

different classes, actuated by different sentiments and views. The

regulation of these various and interfering interests forms the

principal task of modern legislation and involves the spirit of party

and faction in the necessary and ordinary operations of the government. (Hamilton et al p. 74 emphasis added).

The

foundation laid was built upon brick by brick, as when De Tocqueville

visited fifty years later, his opening remarks in his travelogue and ode

to Democracy in America was to note: “Amongst the novel objects that

attracted my attention during my stay in the United States, nothing

struck me more forcibly than the general equality of conditions.” (De

Tocqueville p. 11). The question is how we got from the place where the

founders were careful to note the balance between competing classes to

the one where foreign visitors would call our equality the most notable

thing about our civilization to one where some of our most eminent

economists are worried about the rich creating a separate society walled

off from the rest of their fellow citizens. One answer would be to look

at a separate, but related thread that flows from founding ideals.

There is the idea of the individual alone in nature, at the frontier who

can make or break his or her own destiny because America is the land of

opportunity. It runs from the pioneers and the gold rushes to the

entrepreneurial spirit of gilded age robber barons from Carnegie to

Rockefeller to Ford to Gates to Zuckerberg. This is the America that

capitalism made with the risk-taker’s hand on the tiller, a dynamic

system where the Schumpeterian creative destruction contains the seeds

of the new rebirth (Schumpeter p. 84). These are the two conflicts that

have been in tension from the earliest days of society, but these

tensions helped birth the American dream, one where everyone had a shot,

and one where, as the sociologist Robert Putnam puts in in his

examination of one town’s encounter with modernity and the loss of that

dream: “The children of manual workers and of professionals came from

similar homes and mixed unselfconsciously in schools and neighborhoods,

in scout troops and church groups”. This was a world where families were

intact with homes owned by those families and a sense of community

existed — there were no strangers (Putnam p. 34).

What

is interesting is that in many ways, American society is failing both

ideals, the land of equality and the land of opportunity. As we saw

above, both the Occupy and Tea Party movements birthed books and thought

on inequality in the society, and research continues to shine a light

on the struggles of average Americans. For example, Princeton economists

Anne Case and Angus Deaton made headlines as they surveyed the white

working class, telling their readers: “Although midlife mortality

continued to fall in other rich countries, and in other racial and

ethnic groups in the United States, mortality rates for WNHs age 45–54

increased from 1998 through 2013. Mortality declines from the two

biggest killers in middle age — cancer and heart disease — were offset

by marked increases in drug overdoses, suicides, and alcohol-related

liver mortality in this period.” (Case and Deaton p. 398). If we accept

their findings, we must accept the idea that there is something going on

that is more than economically driven, a moral rot created by

hopelessness of some kind, post-capitalism anomie. The authors called

this excess mortality “deaths of despair”. Looking at it from the

accelerated end-of-life perhaps is the wrong starting place though. The

American system fails to live up to its founding ideals economically

from the beginning. First off is that we still have many of our citizens

living in absolute poverty. Dylan Matthews in Vox.com writes “In early

2011, 1.5 million American households, including 3 million children,

were living on less than $2 in cash per person per day. Half of those

households didn’t have access to in-kind benefits like food stamps,

either.” These are numbers, he adds, that have gone up since the

Clinton-era welfare reforms. (Matthews). Unfortunately, many of the

people who suffer at the low end of the income scale are people of

color, those whose ancestors do not fit nicely into the stories we tell

about ourselves. Though America ended slavery, it took over eighty years

in which all Americans were complicit in the exploitation of the slave

population, north and south. These inequities continue. A report from

the Center for American Progress notes, “In 2016, the median wealth for

black and Hispanic families was $17,600 and $20,700, respectively,

compared with white families’ median wealth of $171,000.” This gap can

be observed “regardless of households’ education, marital status, age,

or income.” (Hanks). Education reinforces these inequities, as recent

research from Georgetown University’s Center on Education and Workforce

notes that in Alabama, “32 of every 100 college-age residents are black,

but only seven of every 100 students at the state’s selective public

colleges are black.” (Mitchell). Even those who do get to school often

find themselves loaded with student loan debt, which Julie

Margetta-Morgan, a fellow at the Roosevelt Institute, calls a “failed

social experiment where the government thought that it would be fine to

give people student debt because that would pay off in the long run and

we’re seeing that’s not the case.” (Berman). Increasing educational

attainment has not full paid off in terms of life outcomes. One

mechanism is that as more people go to college, jobs can require more

credentials for the same position at the same pay. This credential

inflation devalues the return to the new degrees.

At

the same time the idea of opportunity is dropping. One way to look at

this is the creation of new businesses. Though the companies in Silicon

Valley get the lion’s share of the attention, and the idea that the

current American business model is one of the new Schumpeterian creative

destruction as the tech elite disrupt existing business models, the

light shined over there ignores the rest of the economy. The rest of the

economy shows a different story. Census Bureau reporting tracks the

creation of new companies. In 1980, almost fifteen percent of all

companies were new companies, defined as companies as less than a year

old. By 2015, that total had dropped almost half, to eight percent. New

companies inject the dynamism in the economy, create new jobs, and are

often more productive. One economist who has studied this, Marshall

Steinbaum, points to the power of existing firms: “You’ve got rising

market power. In general, that makes it hard for new businesses to

compete with incumbents. Market power is the story that explains

everything.” (Casselman). On the other side of it is a lack of mobility.

One way of looking at mobility is how a person’s initial position in

the income distribution cements the ultimate position in the income

distribution. Examining data on this from the Panel Study of Income

Dynamics, Bhashkar Mazumder notes a broad consensus that

intergenerational income mobility is “relatively low in the United

States, especially when compared with other advanced economies”.

Mazumder observes that the view of America as a highly mobile society

and a “land of opportunity” may be unwarranted. (Mazumder). Part of this

is limited by geographic immobility. Raj Chetty and his coauthors of

the American Opportunity Atlas where they “trace the roots of outcomes

such as poverty and incarceration back to the neighborhoods in which

children grew up. We find that children’s outcomes vary sharply across

nearby tracts” (Chetty et al p. 2). Geography is destiny as past social

engineering projects like redlining and selective zoning, combined with

white flight and blockbusting, have created zones of entrenched poverty,

so that looking at “data shows many neighborhoods where families had

little money decades ago and produced kids who make little money as

adults. And even though many of the kids have moved away, these

neighborhoods continue to house families that make little money.”

(Reyes). Finally, we also see that moving away is difficult. In

examining geographic mobility data, the Brookings Institute notes that

those lower on the income scale are able to move. This geographic stasis

being a problem as moving, throughout the nation’s history, has been a

way for seeking out new opportunity and bettering one’s self. Of course,

moving takes resources the poor do not often have, “diminished mobility

is often caused by limited means: young adults from low-income families

may have less of a family safety net to fall back on in the event of

employment setbacks, less information about opportunities in distant

locations, or simply fewer resources to fund a move.” (Nunn).

Ultimately, from the evidence we have looked at here, the conclusion is

easy to draw. Those who are concerned about inequality and its effects

have a stronger case. Not only is absolute poverty persistent, but also

through the educational system race based, class based and geographical

inequities follow people through their lives so that it is much harder

to move both through the income distribution and in place. Putnam’s

mingled communities of his 1950’s American dream have turned towards the

Stiglitzian fear of gated communities where the rich never see the poor

unless they are checking them out at the store or moving their lawn.

Why

does this inequality persist? To understand the debate between those

who are concerned about inequality and those who dismiss it we need to

look at the ethical framework driving the arguments of those who have

the power and make the policy decisions that help entrench the rich and

prevent mobility of the poor. This understanding must come from an

understanding of economic history. The standard welfare theorems of

economics have their base in utilitarianism philosophy from the

nineteenth century, when there was less of a solid wall between

philosophy and economics. The thinker John Stewart Mill defined

utilitarianism, in his book of the same name thusly: “The creed which

accepts as the foundation of morals “utility” or the “greatest happiness

principal” holds that actions are right in the proportion as they tend

to promote happiness; wrong as they tend to produce the reverse of

happiness. By happiness is intended pleasure and the absence of pain; by

unhappiness, pain and privation of pleasure.” (Mill p. 7). On the face

of things, this is not a bad framework for a moral stance, but it does

beg some questions from an economic standpoint, about units and

aggregates: How does one measure happiness, is happiness subjective, are

there diminishing returns to happiness, what does a society where

happiness is maximized look like? Economists coming after Mill

formalized these questions into the marginal neoclassical economics that

we know today, where every economic actor is solely a self-interested

agent. These self-interested agents as they maximize their happiness

will eventually attain a point of Pareto Optimality, which is an outcome

where there would be no other outcome within the existing economic

constraints that would make one person better off without making any

other person worse off (Bowles et al p. 60). A problem with a Pareto

condition is that there are many Pareto Optimal distributions. If the

Gini Coefficient is one, and one economic actor has all the resources,

this is an “Optimal” point, as it is impossible to make any of the other

economic actors in the population better off without taking resources

away from the singular economic actor who has somehow obtained all the

resources. What the Pareto Optimal condition based on utilitarian

thinking does is cement the status quo as it assumes that the current

position is optimal in terms of efficiency because the point has been

reached through mutually beneficent trade. In this view, if inequality

exists, it is through the benign workings of the market mechanism and

not through the exercise of power of any sort, be it economic or

political.

What

is needed is a different perception of ethics than the one based on

utilitarianism happiness maximization. By using a different framework,

namely that as outlined by the philosopher John Rawls in his A Theory of Justice,

policy decisions of both economic and political import will be made in a

more equitable manner. Rawls, in his work, uses the utilitarian

framework as one that runs counter to his preferences of justice as

fairness. He writes, “The striking feature of the utilitarian view of

justice is that it does not matter, except indirectly, how the sum of

satisfactions is distributed among individuals,” continuing, “Society

must allocate its means of satisfaction, whatever these are, rights and

duties, opportunities and privileges, and various forms of wealth, so as

to achieve the maximum it can” (Rawls p. 26). Instead of using the

utilitarian framework, Rawls looks instead at utilizing a social

contract. With this social contract, the basics are that the principal

of justice are those so that the basic structure of society is based on

original agreement. In this agreement, the basic rules of the game would

be played out, where “Men are to decide in advance how they are to

regulate their claims against one another and what is to be the

foundation of the charter of their society” (Rawls p. 11). As we have

seen earlier, the United States has just this chance earlier in its

history as they wrote the constitution and its framers defended the

document in the Federalist papers. The key part of a Rawlsian social

contract is that the for the framers of the contract “no one knows his

place in society, his class position or social status, nor does anyone

know his fortune in the distribution of natural assets and abilities,

his intelligence, his strength, and the like” (Rawls p. 12). The

formulation is such that no one when choosing the setup of society knows

where they will be in terms of class or race or in the income

distribution so that they cannot make policy to benefit themselves or

their peers. The blind position is called by Rawls the “Veil of

Ignorance”. The Rawlsian approach is not a novel approach for evaluating

inequality. Anthony Atkinson, in his book Inequality: What Can Be Done, acknowledges

that a Rawlsian framework “takes us well beyond utilitarianism”

(Atkinson p. 12). Mankiw also regards the position in his ode to the one

percent. He takes the argument and tries to over-extend it: “Take the

logic a bit further. In this original position, people would be

concerned about more than being born rich or poor. They would also be

concerned about health outcomes. Consider kidneys, for example.” Mankiw

want the reader to imagine a world where all outcomes are considered and

thus from the start, we would sign insurance contracts against having

kidney disease. (Mankiw p. 32). What Mankiw fails to consider is that

uncertainty about the original position is the entire point of justice

as fairness, so that the framers of the social contract make sure that

all have access to the needed resources.

What

Mankiw does as he tries to reduce the veil of ignorance to absurdity is

raises the question of what policy-making looks like in a world in

which we have accepted a different theory of social justice that is not

based on utilitarian thinking. To think about these policy

recommendations, it is simple enough to walk back though the identified

current inequities and suggest alternatives. Americans like to think of

themselves as working in the land of opportunity and the land of the

free but so much of the rhetoric is about the current position and not

what would be the most equitable from an original position. Policy is

seen in terms of zero-sum games so that any redistribution is seen as

stealing what has been rightfully earned. Barring another major civil

war or constitutional convention, there will not be any chance to

formalize the social contract in line with a Rawlsian approach to

justice. This means that we need to think of policy as if we are behind

the veil of ignorance, which is a harder thing to do, since we are

already aware of our class and race geographic positions and cannot

readily deny them. One example of policy that would be recommended is to

rethink how we fund or institutions of education from the primary to

the tertiary level. The current method of funding at the primary and

secondary level are based on property taxes. By funding them in this

manner, the more well off districts can create the atmosphere for better

learning and more opportunity for their students. At the same time,

those students in poorer districts eat lunches of low quality that are

prepared at a central office and study at schools that do not have their

own library. As we saw, this inequity passes onto the college level,

were the makeup of the college classes are tilted towards the well off

and towards the racial majorities at the expense of the minorities.

Those from the less well-off areas who borrow end up with debt which

replicates the cycle of poverty as increasing student debt inhibits

household formation and other consumption that meets the expected

standards of living. So instead of looking at the funding of schools

from local tax receipts, this could be funded at the state or national

level to erase some of the inequities of geography and to give all the

same opportunities at an educational level. A counter example to this

methodology is looking at the implementation of the Affordable Care Act.

By relying on states to design rules for and implement the program,

there is a divergent access to health care across the fifty states.

Reformulating the educational taxation methodology is not a rewriting of

the social contract, but one place we could start as we grasp towards

creating a society that we would want to be part of even if we did not

know where we would start from.

And

yet! School funding just scratches the surface of what is possible if

we were to move towards a non-utilitarian ethical framework. A society

could be created that moves back towards American ideals and against the

gated communities where many would never have the chance to scale the

walls because they are so high and the gates are so thick. Nevertheless,

this is not to dismiss the possibility. With the Occupy Movement and

Sanders candidacy and the long shadow of the 2008 financial crisis, a

new generation has arisen acknowledged that the current social structure

is untenable.

Bibliography

A quote from The Panda’s Thumb. (n.d.). Retrieved from https://www.goodreads.com/quotes/99345-i-am-somehow-less-interested-in-the-weight-and-convolutions

All Too Humanitarian. (n.d.). Retrieved October 21, 2018, from https://www.commonwealmagazine.org/all-too-humanitarian

Amadeo, K. (n.d.). When and Why Did the Stock Market Crash in 2008? Retrieved from https://www.thebalance.com/stock-market-crash-of-2008-3305535

America, F. 1. (n.d.). Nobel Laureate Paul Krugman: Too Little Stimulus in Stimulus Plan. Retrieved from http://knowledge.wharton.upenn.edu/article/nobel-laureate-paul-krugman-too-little-stimulus-in-stimulus-plan/

American Recovery and Reinvestment Act (ARRA): Details. (n.d.). Retrieved from https://www.thebalance.com/arra-details-3306299

Atkinson, A. B. (2018). Inequality — what can be done? Harvard University Press.

Barr,

A., Cook, S. A., Carlin, J. P., Moss, B. P., & Cooper, R. (2010,

October 28). The GOP’s no-compromise pledge. Retrieved from https://www.politico.com/story/2010/10/the-gops-no-compromise-pledge-044311

Berman, J. (2018, October 18). America’s $1.5 trillion student-loan industry is a ‘failed social experiment’. Retrieved from https://www.marketwatch.com/story/americas-15-trillion-student-debt-is-a-failed-social-experiment-2018-10-16

Bloomberg

View. (2018, May 24). The Rich Get the Most Out of College — Bloomberg

View — Medium. Retrieved October 21, 2018, from https://medium.com/bloomberg-view/the-rich-get-the-most-out-of-college-d2ee6ecd8561

C.,

R., F., N, J., H., N., . . . R, S. (2018, October 11). The Opportunity

Atlas: Mapping the Childhood Roots of Social Mobility. Retrieved from https://www.nber.org/papers/w25147

Calmes, J. (2009, January 28). House Passes Stimulus Plan With No G.O.P. Votes. Retrieved from https://www.nytimes.com/2009/01/29/us/politics/29obama.html

Case, A., & Deaton, A. (2017). Mortality and Morbidity in the 21st Century. Brookings Papers on Economic Activity, 2017(1), 397–476. doi:10.1353/eca.2017.0005

Casselman, B. (2017, September 20). A Start-Up Slump Is a Drag on the Economy. Big Business May Be to Blame. Retrieved from https://www.nytimes.com/2017/09/20/business/economy/startup-business.html

CBO

FEBRUARY 2015 Estimated Impact of the American Recovery and

Reinvestment Act on Employment and Economic Output in 2014. (n.d.).

Retrieved from https://www.cbo.gov/sites/default/files/114th-congress-2015-2016/reports/49958-ARRA.pdf

Conard, E. (2016). The upside of inequality: How good intentions undermine the middle class. New York, NY: Portfolio/Penguin.

Delsol, J., Lecaussin, N., & Martin, E. (2017). Anti-Piketty: Capital for the 21st century. Washington, D.C.: Cato Institute.

Election Results. (n.d.). Retrieved from https://www.nytimes.com/elections/2012/results/states/new-york.html

Galbraith, J. K. (2016). Inequality: What everyone needs to know. New York: Oxford University Press.

Hamilton, A., Madison, J., Rossiter, C., Jay, J., & Kesler, C. R. (2005). The federalist papers. New York: Signet Classics, an imprint of New American Library, a division of Penguin Group (USA).

Hanks, A., Solomon, D., & Weller, C. E. (n.d.). Systematic Inequality. Retrieved from https://www.americanprogress.org/issues/race/reports/2018/02/21/447051/systematic-inequality/

Kirell, A. (2015, October 30). When CNBC Created the Tea Party. Retrieved from https://www.thedailybeast.com/when-cnbc-created-the-tea-party

Lalinde,

J., Sacks, R., Guiducci, M., Nicholas, E., & Chafkin, M. (2015,

September 17). An Oral History of Occupy Wall Street. Retrieved from https://www.vanityfair.com/news/2012/02/occupy-wall-street-201202

Loewen, J. W. (2018). Lies my teacher told me: Everything your American history textbook got wrong. New York: The New Press.

Mankiw, N. G. (2013). Defending the One Percent. Journal of Economic Perspectives, 27(3), 21–34. doi:10.1257/jep.27.3.21

Matthews,

D. (2015, September 02). Selling plasma to survive: How over a million

American families live on $2 per day. Retrieved from https://www.vox.com/2015/9/2/9248801/extreme-poverty-2-dollars

Mazumder, B. (2018). Intergenerational Mobility in the United States: What We Have Learned from the PSID. The ANNALS of the American Academy of Political and Social Science, 680(1), 213–234. https://doi.org/10.1177/0002716218794129

Milanović, B. (2018). Global inequality: A new approach for the age of globalization. Cambridge, MA: The Belknap Press of Harvard University Press.

Mill, J. S., & Sher, G. (2002). Utilitarianism. Hackett Publishing Co.

Mitchell, M. (2018, November 16). New report says America’s public universities are separate and unequal. Retrieved from https://chicago.suntimes.com/columnists/college-university-higher-education-separate-unequal-blacks-whites-latinos/

Nunn, R., Parsons, J., & Shambaugh, J. (2018, November 20). Americans aren’t moving to economic opportunity. Retrieved from https://www.brookings.edu/blog/up-front/2018/11/19/americans-arent-moving-to-economic-opportunity/

Piketty, T., & Goldhammer, A. (2017). Capital in the twenty-first century. Cambridge: Belknap Harvard.

Putnam, R. D. (2016). Our kids: The American Dream in crisis. New York: Simon & Schuster.

Rawls, J. (2003). A theory of justice. Cambridge, MA: Belknap Press of Harvard University Press.

Reyes,

C., & Mahr, J. (2018, October 16). Same city, different

opportunities: Study maps life outcomes for children from Chicago

neighborhoods. Retrieved from https://www.chicagotribune.com/news/watchdog/ct-american-dream-for-chicago-analysis-htmlstory.html

Schumpeter, J. A. (2009). Capitalism, socialism and democracy. New York: Harper perennial.

Senate Results Map. (n.d.). Retrieved from https://www.nytimes.com/elections/2010/results/senate.html

Staff, I. (2018, May 23). Dodd-Frank Wall Street Reform and Consumer Protection Act. Retrieved from https://www.investopedia.com/terms/d/dodd-frank-financial-regulatory-reform-bill.asp

Stiglitz, J. E. (2013). The price of inequality: How todays divided society endangers our future. New York: W.W. Norton.

The closing of the jobs gap: A decade of recession and recovery. (2017, November 07). Retrieved from https://www.brookings.edu/research/the-closing-of-the-jobs-gap-a-decade-of-recession-and-recovery/

The Constitution of the United States: A Transcription. (n.d.). Retrieved from https://www.archives.gov/founding-docs/constitution-transcript

The Declaration of Independence. (n.d.). Retrieved from https://www.archives.gov/founding-docs/declaration

Tocqueville,

A. D., Bevan, G., & Tocqueville, A. D. (2003). Democracy in

America ; and, Two weeks in the wilderness. London: Penguin.